- Solutions

SOLUTIONS

- Consultancy

- Academy

- Accelerator

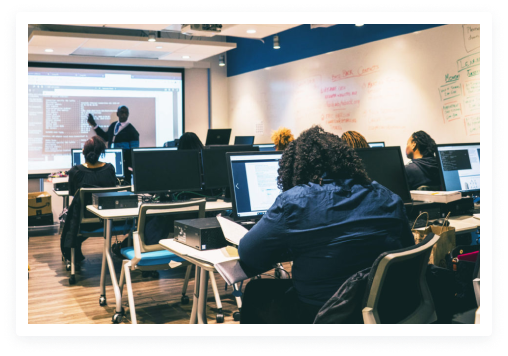

Cryptocurrency Academy for Business Owners & Executives

Cryptocurrency Academy for Business Owners & Executives

Overview

The system of finance and wealth management that you have complete control of have changed since the advent of blockchain technology. Think about that for a minute.

Getting started can be a bit intimidating at first. However, once you get started with our Executive Training, you will be amazed at the ease and benefits of handling without all restrictions. We provide one-on-one, (or via web), training to walk you through setting up. We will also discuss proper requirements.

With the use of Decentralized Finance what is called DeFi. Assets can be used to create new assets of the same coin or token.

What you will learn

Our training will walk you through setting up on a platform you can use on a daily basis. Spend any crypto assets as you wish. you will learn how to get cash from your crypto currencies and many other daily use benefits. We will share how this operate on a daily basis.

Blockchain and cryptocurrency was Once considered a ‘fad’ reserved for digital investors, geeky coders, and early tech millionaires among Cyberpunk community

Now with a market capitalization of over $1 trillion way ahead of what was once big four Inseparable company of FAANG, bitcoin market cap alone today 9th January 2022, is way ahead of Facebook and JP Morgan, Alibaba, and Warren buffet company Berkshire Hathaway, Visa and Mastercard, the world of crypto today offers people the opportunity to trade in an alternative system where they can have more control over their wealth.

Blockchain represent a new shift in the way and manner information is shared, hence institutions are curious to figure out how they can use the distributed ledger technology to save times and reduce costs across their services.

It is a decentralized or distributed ledger where each node in the network has access to the data or records stored in a blockchain. The encryption of all the important data records in the blockchain is done using cryptographic techniques. This ensures the security of the data in the blockchain.

A cryptocurrency is a digital or virtual currency that is secured by cryptography, which make it nearly impossible to counterfeit or double-spend.

A defining feature of cryptocurrencies is that they are generally not issued by any central body or authority, rendering them theoretically immune to government interference or manipulation.

Smart contract are digital protocols for information transfer that use mathematical algorithms to automatically execute a transaction once the established conditions are met and that fully control the process.

The uses of such contracts are limitless, as they can be used to build decentralized exchanges, tokenized assets, games and more. In its construction, smart contracts disrupt not only legal spaces, but financial spaces as well.

Digital assets have become a potency for innovation since invention in the aftermath of the 2008 financial crisis. The blockchain technology has driven the value of the digital asset sporadically.

It is built on a long history of technological advancements in computer science, cryptography, and digital scarcity, and its disinflationary nature is designed to facilitate trust minimized, peer-to-peer transactions without a centralized intermediary in a highly secure and transparent way.

Treasury reserve policy are sets of roles and responsibilities, and practices for managing all treasury reserve Assets. i.e Cash Assets held by the organisation and its subsidiaries and digital assets held by the company

This Policy helps address legal requirements and business risks that may apply to the Company’s management of Treasury Reserve Assets (“Reserve Management”), with a focus on Digital Asset as the Company’s primary Treasury Reserve Asset.

Cryptocurrencies and digital token challenge traditional financial reporting boundaries. The accounting for digital asset is an emerging area where accountants should be looking at with a way of providing accounting guidance.

The primary aim of this study is to have a deeper understanding on cryptocurrencies regulations, the different tax terms used in the crypto market and simple methods to file.

Bitcoin and other cryptocurrencies are relatively simple to record at the point of purchase because corporations typically know the amount paid for an asset and minimal judgement is required. However, the subsequent analysis and accounting need a great deal of judgement and subjectivity.

Companies should carefully examine, based on the Board’s and management’s total risk tolerance:

How often should the organisation examine the relevant cryptocurrency’s price?

On what pricing index will the firm rely?

What are the percentage change thresholds that a corporation should use?

Smart treasury will imply various things to different companies, especially when you consider their size, industry, and operating environment. In the end, a smart treasury should automate day-to-day operational activities, allowing team members to concentrate on more strategic responsibilities.

Technology is frequently at the centre of a smart treasury, especially when it comes to generating deeper insights from data and assisting the rest of the company on its digital transformation and development path.

Digital asset trading policy provides guidelines applicable to all directors, officer and employees of the organization and its subsidiaries for the purpose of management of its investment in digital assets. So as to help avoid trading on inside information in violation of applicable law and regulation, including but limited to federal and state commodity laws and fiduciary duties under applicable corporate law.

Bitcoin has the ability to function and presently has been adopted as legal tender by some countries, thus creating an avenue to serve product and services.

this will become full fledged due to majority adoption as a means of transferring value.

The following are checklist of generally-applicable contractual considerations relevant to custodial service agreements with potential digital asset custodians. This checklist is intended for general background purposes as it contemplate custodian relationship and not as guidance for negotiating any specific custodial agreement.

1.Counterparty

2.Scope of Services

3.Legal Characterization of property

4.Fees

5.Client Responsibilities and Acknowledgement of Risk

There are several risk associates to our entire endeavour, as a matter of fact the higher the risk the greater the return. But one needs to take calculated risk so as not to run into financial loss. Risks abound when it comes to financial transaction, the varieties of which are quite voluminous.

Risk refers to the probability of a negative event happening in your activities; an event that goes contrary to your intended outcome.

Decentralized finance is an umbrella technology for a variety of cryptocurrency finance application in blockchain geared towards disrupting traditional intermediary.

Decentralized finance is often referring to the shift from traditional, centralized finance systems to peer-to-peer finance enable by decentralized technologies build on the Ethereum blockchain.

Unlike cryptocurrencies, where all tokens are created equally, non–fungible tokens are each unique and limited in quantity. NFTs are one of the keys building blocks of a new, blockchain powered digital economy.

Several projects are experimenting with NFTs for a variety of use cases such as gaming, digital identity, licensing, certificate and fine arts. What’s more they can even allow fractional ownership of high-value items.

The Metaverse is a vast network of persistent, real-time rendered 3D environments and simulations that enable continuity of identity, items, history, payments, and entitlements, and can be accessed by a practically infinite number of users, each with their own feeling of presence.

Companies must utilise the Metaverse carefully to produce services that consumers can trust and that align with their beliefs, analysing projected financial outcomes while minimising its environmental effect.